As digitalization accelerates, payment systems are evolving rapidly. While this transformation brings convenience for both businesses and consumers, it also raises significant security challenges.

This is where modern payment gateway systems developed by fintech providers like Firisbe become foundational pillars for both security and efficiency.

What Is a Payment Gateway and Why Does It Matter?

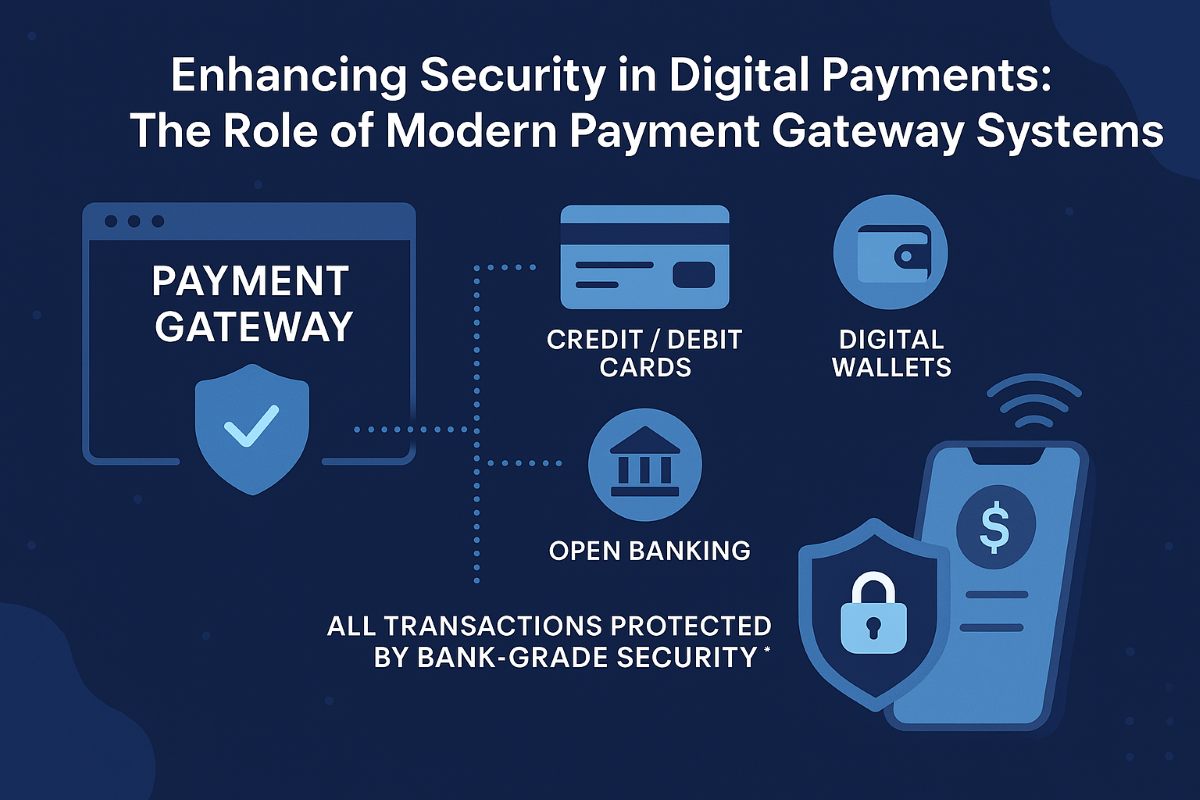

A payment gateway is the secure digital bridge between a customer and the bank, processing transactions swiftly and safely. Think of it as the digital counterpart of a physical POS terminal. When a user enters their card details and initiates a payment—whether during online shopping or in a mobile app—the entire backend process is facilitated by the gateway.

Firisbe’s Payment Gateway Platform supports multiple payment methods, including:

- Credit and debit cards

- Digital wallets

- Open banking solutions

- Mobile payment systems

All transactions are protected by bank-grade security protocols.

Digital Payment Security: A Necessity, Not a Luxury

The rise in digital transaction volumes has led to increased cyber threats. Therefore, digital payment security is now critical for businesses of all sizes. Firisbe places data protection at the core of its infrastructure, without compromising transaction speed.

Firisbe’s payment gateway infrastructure includes:

- SSL encryption for secure data transfer

- Tokenization technology to mask card data

- Processing without storing cardholder information, minimizing breach risks

All transactions are monitored in real time to detect and prevent fraudulent activity.

PCI DSS Compliance: The Global Standard in Payment Security

PCI DSS (Payment Card Industry Data Security Standard) is the global benchmark for protecting payment data. All of Firisbe’s payment solutions are fully PCI DSS-compliant.

What does PCI DSS compliance offer?

- Secure handling of cardholder data

- Reduced risk of fraud and data breaches

- Protection from regulatory penalties

- Enhanced customer trust

Firisbe ensures not just technical infrastructure, but also legal and operational protection for businesses.

Integrated & Modular Architecture: Simplifying Payment Integration

In traditional systems, integrating various payment channels is often time-consuming and resource-intensive. Firisbe streamlines this with:

- API-based architecture for rapid deployment

- Compatibility with third-party systems

- Cloud scalability for flexible growth

- Centralized management of all payment methods

This enables businesses to keep pace with evolving payment trends effortlessly.

Virtual POS Security: Peace of Mind with Firisbe

Virtual POS systems are essential for e-commerce, yet also prime targets for cyberattacks. Firisbe provides comprehensive virtual POS security, ensuring maximum protection through:

- No storage of card data during transactions

- Detailed transaction logging

- Real-time fraud detection systems

- Support for 3D Secure authentication

This ensures both customer satisfaction and protection against potential financial loss.

Firisbe’s Security-First Philosophy

Firisbe is not just a software provider—it is a holistic solution provider with security at its core. Its systems are:

- Fully integrated with wallet, user, bank, and card infrastructures

- Cloud-ready for flexible deployment

- Future-proof with ongoing architectural updates

- Compliant with evolving financial regulations

With Firisbe, digital payments become fast, secure, adaptive, and regulation-ready.

Who Can Benefit from Firisbe’s Payment Gateway Solutions?

Firisbe’s payment gateway solutions cater to businesses of all sizes:

- E-commerce platforms

- SaaS providers

- Fintech startups

- Banks and financial institutions

- POS service providers

Whether you’re just starting out or running a high-volume enterprise, Firisbe’s modular structure can be tailored to meet your needs.

Firisbe: The Key to Digital Security

In today’s landscape, digital payment security is no longer optional. Businesses must adopt not only fast but also secure solutions. Firisbe leads the way by delivering excellence in:

- Payment gateway technology

- Seamless payment integration

- PCI DSS compliance

- Robust virtual POS security

- Real-time fraud monitoring

If you’re ready to modernize your payment infrastructure and elevate customer trust, Firisbe is your ideal partner.

The Firisbe Advantage

Basic functionality is no longer enough. Today’s businesses demand:

- Fast and flexible integration

- Uninterrupted transaction processing

- Full compliance with security standards

- Intuitive user experience

Firisbe delivers all of this and more. Its modern payment gateway systems go beyond just processing payments—they secure data, ensure compliance, and enhance user experience at every step.

Thanks to its flexible, API-based infrastructure, businesses from any sector can easily integrate Firisbe into their operations.

Security is non-negotiable. Firisbe’s PCI DSS-compliant systems process payment data at the highest standards. Card information is never stored during virtual POS transactions, and all data is protected via tokenization and fraud detection systems.

Firisbe also offers inclusive payment integration. From credit cards and bank transfers to digital wallets and open banking solutions, all methods can be managed through one centralized platform—maximizing operational efficiency.

Whether you’re a small business or a large enterprise, Firisbe’s cloud-based infrastructure enables rapid deployment and easy maintenance—ready to adapt to your current and future needs.

Firisbe is more than just a technology provider—it is your trusted partner in building a secure, scalable, and user-friendly digital payment strategy.

FAQs

- What is a payment gateway and how does it work?

A payment gateway is the secure digital infrastructure that facilitates online transactions. Firisbe encrypts the communication between the user and the bank to ensure secure data exchange. - Are Firisbe’s payment systems PCI DSS compliant?

Yes. All of Firisbe’s solutions are fully PCI DSS-compliant, ensuring that cardholder data is processed according to international security standards. - What technologies does Firisbe use to secure digital payments?

Firisbe employs SSL encryption, tokenization, transaction logging, and advanced fraud detection systems to secure every transaction. - Is Firisbe’s virtual POS service secure?

Absolutely. Firisbe’s virtual POS ensures security through non-storage of card data, 3D Secure support, and real-time monitoring of transactions. - How does Firisbe handle payment integration?

Firisbe offers fast, flexible integration via its API-driven infrastructure. All payment methods can be managed from a single dashboard. - What payment methods are supported by Firisbe?

Firisbe supports credit cards, debit cards, open banking, digital wallets, and mobile payments. - Can small businesses use Firisbe?

Yes. Firisbe’s modular architecture is ideal for businesses of all sizes—from startups to large enterprises. - Can Firisbe’s systems run in the cloud?

Yes. Firisbe’s solutions are cloud-compatible, ensuring fast deployment, flexibility, and remote management capabilities.

Leave A Comment