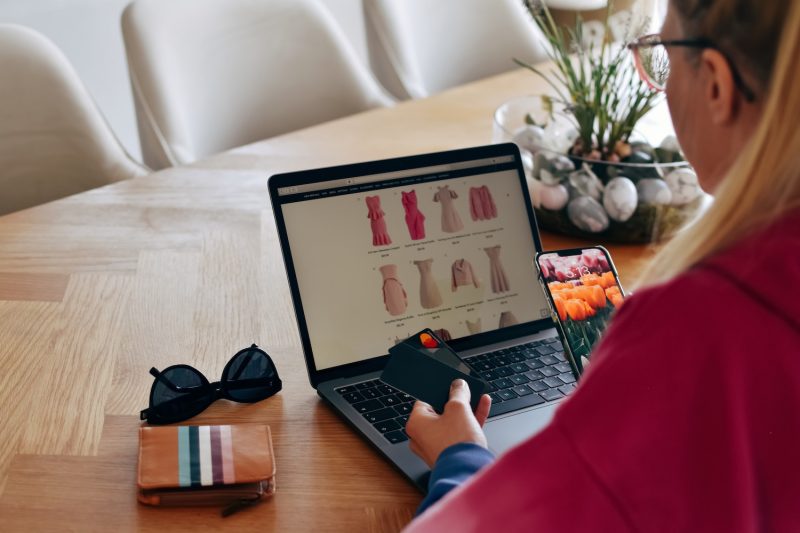

In the rapidly evolving world of e-commerce, businesses increasingly need to accept payments online. In this context, Virtual POS (Point of Sale) systems have become a critical tool for businesses, allowing them to securely and efficiently process payments over the internet. A Virtual POS can be seen as the digital version of physical POS devices found in brick-and-mortar stores, enabling customers to make payments using credit or debit cards during online shopping.

What is Virtual POS? Use Cases?

A Virtual POS is a payment solution that allows businesses to accept credit and debit card payments through their websites. This system is essentially an internet-based version of traditional POS devices and is commonly used on e-commerce sites. Virtual POS is a service provided by payment processors, ensuring that card information provided by customers is processed securely.

Virtual POS is not limited to e-commerce sites alone. It is also widely used by companies offering subscription-based services, businesses accepting online bill payments, and firms making sales through mobile applications. This system is considered a fundamental payment acceptance tool for all businesses engaged in online sales.

Advantages of Virtual POS

- Security: Virtual POS systems use various security protocols to make payment transactions secure. SSL (Secure Socket Layer) certificates encrypt data during transmission, preventing unauthorized access to customer payment information. Additionally, 3D Secure technology adds an extra layer of verification for transactions. PCI DSS (Payment Card Industry Data Security Standard) compliance ensures secure processing and storage of payment information.

- Speed and Convenience: Virtual POS enables instant transaction processing, which is highly convenient for both businesses and customers. Customers can quickly complete their purchases, while businesses can receive payments immediately, aiding in cash flow management. This speed and convenience optimize the shopping process and increase customer satisfaction.

- Customer Satisfaction: The ability to accept online payments provides customers with more payment options and enhances the shopping experience. Customers can use credit cards, debit cards, or digital wallets, which improves customer satisfaction. A wide range of payment options makes it easier for customers to complete their purchases and reduces cart abandonment rates.

- 24/7 Sales Capability: Virtual POS allows businesses to accept payments around the clock. Unlike physical stores, online businesses can generate revenue continuously without time constraints. This is particularly advantageous for businesses targeting global markets, as it provides the opportunity to serve customers in different time zones.

How to Apply for Virtual POS?

To apply for a Virtual POS, businesses need to prepare certain documents and information. Typically required documents include the company’s trade registry newspaper, tax plate, signature circular, copies of identification, and bank account information. These documents are necessary for evaluating and approving the application.

The application process involves several steps. The first step is to fill out an online application form on the Virtual POS provider’s website. This form includes the business’s basic information and contact details. After submitting the form, the required documents are sent to the provider, and the application process begins. The provider evaluates the application and performs a credit assessment of the business, considering factors like financial status and payment history. Once approved, Virtual POS integration is initiated, and the necessary API keys are provided to the business.

Important considerations during the application process include providing accurate and complete information, ensuring documents are current and correct, and carefully reviewing the terms and commission rates of the Virtual POS provider. Choosing a provider that fits the business’s needs and expectations will ensure more efficient and profitable use in the long term.

Virtual POS Providers

There are many providers offering Virtual POS services, including banks and specialized payment service providers. Banks typically offer reliability and extensive customer support, providing a secure solution for businesses. However, it is important to consider the commission rates and other fees associated with bank-provided Virtual POS services.

Payment service providers often offer faster integration processes and flexible solutions, making them ideal for small and medium-sized businesses. These firms are known for their wide range of integration options and user-friendly interfaces.

When choosing a Virtual POS provider, consider the following criteria:

- Security: Check the provider’s security protocols and PCI DSS compliance to ensure the safety of business and customer information.

- Commission Rates: Compare commission rates as they impact the business’s costs. Rates typically range from 1% to 3% and may vary with sales volume.

- Integration Ease: Evaluate whether the provider’s integration solutions are compatible with your website.

- Customer Support: Ensure that the provider offers adequate support for technical issues and integration.

Virtual POS Usage Fees

There are several fees to consider with Virtual POS usage, including commission rates, setup fees, and additional service fees.

- Commission Rates: These are percentage-based fees charged by the Virtual POS service providers for each transaction. Rates generally range between 1% and 3% and may vary based on the business’s sales volume. Higher sales volumes typically lead to lower commission rates.

- Setup Fees: These are one-time fees for setting up the Virtual POS service and are generally part of the integration process. The setup fee may vary depending on the services and support provided by the provider.

- Additional Service Fees: These fees cover extra services and technical support offered by the Virtual POS provider, such as additional reporting tools, fraud prevention services, or specialized customer support. These services are typically included in a service package and are chosen based on business needs.

Virtual POS Integration

Virtual POS integration starts by adding the payment provider’s APIs to the business’s website. This process is typically handled by web developers and follows the provider’s documentation. Careful execution of the integration process ensures smooth transaction processing.

Popular e-commerce platforms are often compatible with Virtual POS providers. Integration can be facilitated using special plugins or modules designed for these platforms, enabling secure and efficient payment processing.

Technical requirements for Virtual POS integration include ensuring the website has an SSL certificate and complies with PCI DSS standards. Providers usually offer technical support during integration to help with necessary adjustments and ensure secure payment processing.

Virtual POS systems are a critical part of e-commerce and online payment acceptance, playing a significant role in digital transformation for businesses. With their security, speed, and user-friendly design, Virtual POS systems enable businesses to enhance customer satisfaction, conduct 24/7 sales, and manage cash flow effectively. Ultimately, the use of Virtual POS offers a broad range of payment options, improves customer satisfaction, and provides a competitive edge.